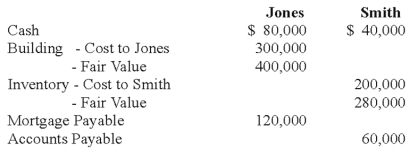

Jones and Smith formed a partnership with each partner contributing the following items:

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

-Refer to the above information.What is the balance in each partner's capital account for financial accounting purposes?

Definitions:

Love

A complex set of emotions, behaviors, and beliefs associated with strong feelings of affection, warmth, and respect for another person.

Humanistic

A psychological perspective focusing on individual potential and stress on the importance of growth and self-actualization.

Psychology

The scientific study of the mind and behavior, encompassing various aspects of human experience and including different fields such as cognitive, emotional, and social processes.

Potential for Growth

The inherent ability or capacity of an organism, individual, or entity to expand, develop or improve.

Q2: All of the following are elements of

Q3: "Classification of contributions restricted by purpose" describes

Q5: Refer the information provided above.Assuming the U.S.dollar

Q10: Refer to the information given above.What amount

Q15: Based on the preceding information,which of the

Q16: Based on the preceding information,what journal entry

Q17: Which of the following funds are classified

Q34: Which sections of the cash flow statement

Q36: Based on the preceding information,in the journal

Q57: The general fund of Gillette levied property