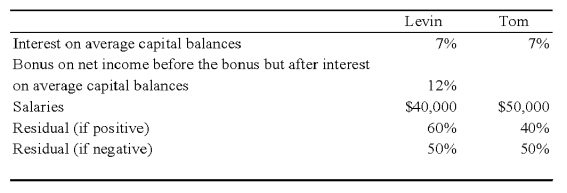

Net income for Levin-Tom partnership for 2009 was $125,000.Levin and Tom have agreed to distribute partnership net income according to the following plan:

Additional Information for 2009 follows:

1.Levin began the year with a capital balance of $75,000.

2.Tom began the year with a capital balance of $100,000.

3.On March 1,Levin invested an additional $25,000 into the partnership.

4.On October 1,Tom invested an additional $20,000 into the partnership.

5.Throughout 2009,each partner withdrew $200 per week in anticipation of partnership net income.The partners agreed that these withdrawals are not to be included in the computation of average capital balances for purposes of income distributions.

Required:

a.Prepare a schedule that discloses the distribution of partnership net income for 2009.Show supporting computations in good form.

b.Prepare the statement of partners' capital at December 31,2009.

c.How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $45,000 to Levin and $60,000 to Jack?

Definitions:

Income Tax

A tax levied by governments on individuals' or entities' income and earnings.

Distance Learning

A method of education that allows students to study and learn remotely without being physically present in a traditional classroom setting.

Average Total Cost

The total cost of production divided by the quantity of output produced, representing the cost per unit of output.

Average Variable Cost

Average variable cost is the total variable cost divided by the quantity of output produced, indicating the variable cost of producing each unit of output.

Q3: Which of the following observations is true

Q14: Listen and Hear are thinking of dissolving

Q21: Event is reasonably possible but amount is

Q24: Based on the preceding information,what balance would

Q29: Refer to the above information.Assuming Perth's local

Q32: Based on the information given,which eliminating entry

Q35: All of the following are examples of

Q45: Toledo Imports,a calendar-year corporation,had the following income

Q84: Which of the following will have no

Q105: For the year ended June 30,20X9,a university