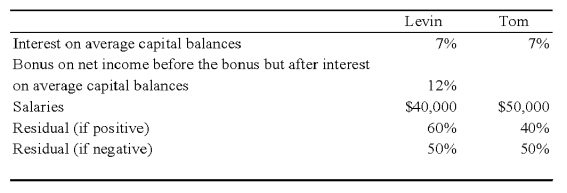

Net income for Levin-Tom partnership for 2009 was $125,000.Levin and Tom have agreed to distribute partnership net income according to the following plan:

Additional Information for 2009 follows:

1.Levin began the year with a capital balance of $75,000.

2.Tom began the year with a capital balance of $100,000.

3.On March 1,Levin invested an additional $25,000 into the partnership.

4.On October 1,Tom invested an additional $20,000 into the partnership.

5.Throughout 2009,each partner withdrew $200 per week in anticipation of partnership net income.The partners agreed that these withdrawals are not to be included in the computation of average capital balances for purposes of income distributions.

Required:

a.Prepare a schedule that discloses the distribution of partnership net income for 2009.Show supporting computations in good form.

b.Prepare the statement of partners' capital at December 31,2009.

c.How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $45,000 to Levin and $60,000 to Jack?

Definitions:

Job Order Cost Accounting

A method of accounting that accumulates costs for each job or project separately, often used in manufacturing or service industries.

Direct Labor Costs

Expenses associated with employees who directly contribute to the manufacturing or production of goods.

Work in Process

Partially finished goods that are in production but have not yet been completed at a specific point in time.

Cost Ledger

A subsidiary ledger that contains individual accounts for each type of cost, including materials, labor, and overhead, used in process costing systems.

Q6: Which monthly report shows the results of

Q11: The accounting statement of affairs is prepared:<br>A)at

Q14: When a new partner is admitted into

Q17: Based on the preceding information,in the preparation

Q23: Based on the information provided,what is the

Q34: Which of the following funds are classified

Q38: Form 10-Q<br>A) Provides preliminary information to investors

Q43: Assume that Bricks declared a stock dividend

Q56: The general fund of the City of

Q70: For the year ended June 30,20X9,a private