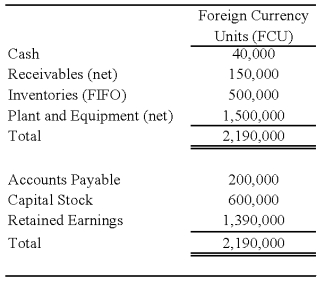

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

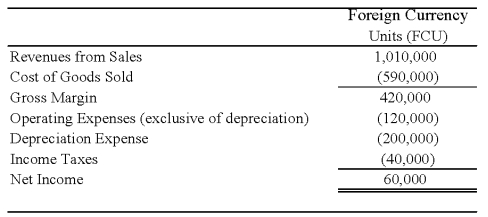

Perth's income statement for 20X8 is as follows:

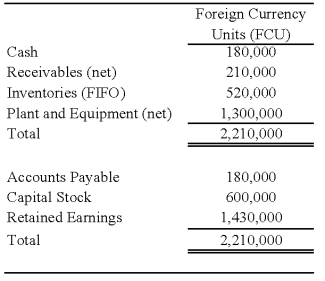

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

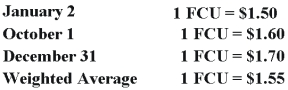

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the balance in Johnson's investment in foreign subsidiary account at December 31,2008?

Definitions:

Amitriptyline

A type of antidepressant medication primarily used to treat symptoms of depression, also helpful in managing pain and improving sleep.

Lorazepam

A benzodiazepine medication used to treat anxiety disorders, insomnia, and provide sedation.

Severe Anxiety

A heightened state of excessive fear or worry that significantly impairs daily functioning and is more intense than typical anxiety reactions.

Coping Strategies

Methods or techniques used to manage or overcome challenging situations or stressors.

Q3: Based on the preceding information,what amount of

Q3: FASB 131 (ASC 280)uses a(n)_ approach to

Q9: Based on the information given above,what amount

Q14: Based on the preceding information,the call option:<br>A)has

Q18: On September 3,20X8,Jackson Corporation purchases goods for

Q35: Which of the following characteristics best describes

Q50: "Reported as an expenditure of the fund

Q51: Refer to the above information.Which statement below

Q96: A voluntary health and welfare organization received

Q111: "Tangible fixed assets not depreciated by a