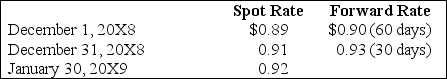

Taste Bits Inc. purchased chocolates from Switzerland for 200,000 Swiss francs (SFr) on December 1, 20X8. Payment is due on January 30, 20X9. On December 1, 20X8, the company also entered into a 60-day forward contract to purchase 100,000 Swiss francs. The forward contract is not designated as a hedge. The rates were as follows:

-Based on the preceding information,the entries on January 30,20X9,include a:

Definitions:

Retiring Partner

A partner who is leaving a partnership, often subject to terms regarding withdrawal, compensation, and responsibilities outlined in a partnership agreement.

Limited Partnership

A business arrangement where at least one partner is liable only to the extent of their investment, while at least one other has unlimited liability.

Legal Position

The status or standing of an individual's or entity's situation according to the law.

Mail-Order Business

A retail operation that sells products directly to customers through catalogs, the internet, or other mail distribution methods.

Q10: Based on the information given above,what amount

Q15: Refer to the above information.On the internal

Q18: On September 3,20X8,Jackson Corporation purchases goods for

Q36: On January 1,20X9 Athlon Company acquired 30

Q38: Interim income statements are required for Smith

Q49: Customary Review

Q55: Based on the information given above,how many

Q57: Which of the following describes a situation

Q58: Based on the preceding information,what is the

Q59: The general fund of Wold Township ordered