On December 1,20X8,Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78.On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

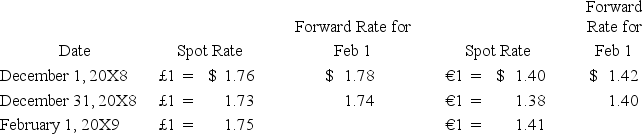

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9.Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9.Ignore taxes.

-Based on the preceding information,what is the net gain or loss on the euro speculative contract?

Definitions:

Mineral Nature

Mineral nature refers to the characteristics and properties of minerals, including their composition, structure, and the processes by which they are formed.

Patent Amortization

The process of gradually writing off the initial cost of a patent over its useful life, reflecting the decrease in value due to time and use.

Credit

The right side of an account.

Accumulated Amortization

The cumulative amount of amortization expense that has been recorded against an intangible asset.

Q3: Based on the preceding information,what is the

Q5: Big Company acquired the following assets and

Q6: If the functional currency is the local

Q12: Based on the information given above,what gain

Q15: Senior Inc.owns 85 percent of Junior Inc.During

Q16: All of the following stockholders' equity accounts

Q33: Assume that New Life uses the direct

Q46: Pisa Company acquired 75 percent of Siena

Q46: The fair value of net identifiable assets

Q49: Which of the following statements is (are)true?<br>I.In