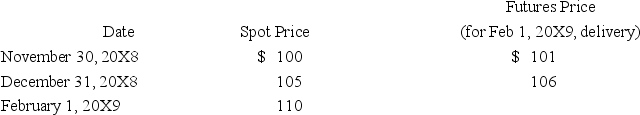

Spiraling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil.On November 30,20X8,AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel,with a February 1,20X9,call date.The following is the pricing information for the term of the call:

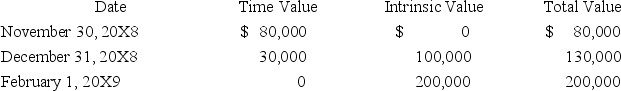

The information for the change in the fair value of the options follows:

The information for the change in the fair value of the options follows:

On February 1,20X9,AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price.On April 1,20X9,AMAR sells the oil for $112 per barrel.

On February 1,20X9,AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price.On April 1,20X9,AMAR sells the oil for $112 per barrel.

-Based on the preceding information,the entries made on April 1,20X9 will include:

Definitions:

Efficiently

Achieving maximum productivity with minimum wasted effort or expense.

Production Inefficiency

A situation where resources are not utilized in the best possible manner, resulting in wasted potential output.

Production Possibility Frontier

A graphical representation that shows the maximum combination of two goods or services that can be produced within a given time period, given available resources and technology.

Economic Growth

A growth in an economy's ability to generate goods and services when comparing two different time periods.

Q1: When there are intercompany sales of inventory

Q10: Based on the information provided,in Golden Path's

Q12: Based on the information provided,the gain on

Q17: Which of the following observations is NOT

Q18: Agency funds report:<br>A)only assets and liabilities.<br>B)assets,liabilities,fund balance,revenues,and

Q20: Based on the information given above,what will

Q22: Ridge Company is in the process of

Q22: Refer to the information provided above.Allen and

Q27: The balance sheet given below is presented

Q41: Based on the information provided,the differential associated