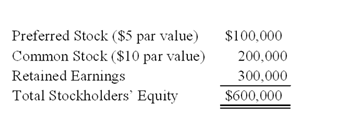

On January 1, 20X9, Company A acquired 80 percent of the common stock and 60 percent of the preferred stock of Company B, for $400,000 and $60,000, respectively. At the time of acquisition, the fair value of the common shares of Company B held by the noncontrolling interest was $100,000. Company B's balance sheet contained the following balances:

For the year ended December 31, 20X9, Company B reported net income of $100,000 and paid dividends of $40,000. The preferred stock is cumulative and pays an annual dividend of 10 percent.

-Based on the preceding information,the eliminating entry to prepare the consolidated financial statements for Company A as of December 31,20X9 will include a credit to noncontrolling interest in net income of Company B for:

Definitions:

Accounts Payable

Liabilities of a business that are due to creditors within a short period, usually one year, and are to be paid in cash or other current assets.

Equipment

Tangible property used in the operations of a business not intended for sale, including machinery, computers, and furniture.

Cash

A form of currency that includes coins and paper bills.

Capital

The wealth in the form of money or other assets owned by a person or organization or available for purposes such as starting a company or investing.

Q2: Based on the information provided,what is the

Q6: Based on the preceding information,what amount of

Q9: Frahm Company incurred a first quarter operating

Q13: Stone Company reported $100,000,000 of revenues on

Q13: Based on the information given above,what amount

Q17: Refer to the information provided above.David directly

Q17: Based on the preceding information,the cost of

Q31: Detroit based Auto Corporation,purchased ancillaries from a

Q31: Based on the preceding information,what amount of

Q42: Consolidated net income for a parent and