On January 1,20X7,Gild Company acquired 60 percent of the outstanding common stock of Leeds Company at the book value of the shares acquired.On that date,the fair value of noncontrolling interest was equal to 40 percent of book value of Leeds.At the time of purchase,Leeds had common stock of $1,000,000 outstanding and retained earnings of $800,000.

On December 31,20X7,Gild purchased 50 percent of Leeds' bonds outstanding which were originally issued on January 2,20X4,at 99.The total bond issue has a face value of $600,000,pays 10 percent interest annually,and has a 10-year maturity.Any premium or discount is amortized on a straight-line basis.Gild paid $306,000 for its investment in Leeds' bonds and intends to hold the bonds until maturity.

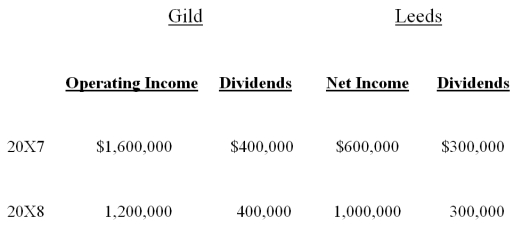

Income and dividends for Gild and Leeds for 20X7 and 20X8 are as follows:

Assume Gild accounts for its investment in Leeds stock using the fully adjusted equity method.

Required:

A)Present the worksheet elimination entries necessary to prepare consolidated financial statements for 20X7.

B)Present the worksheet elimination entries necessary to prepare consolidated financial statements for 20X8.

Definitions:

Market-Based

Economic systems or policies that are reliant on the forces of supply and demand rather than governmental interventions to allocate resources.

Command-And-Control Policies

Government interventions that directly regulate permissible levels of emissions or methods of production, through mandates or restrictions.

Externalities

Financial repercussions impacting individuals who are not primary participants, with effects ranging from beneficial to harmful.

Market-Equilibrium

A condition where market supply equals market demand, resulting in stable prices where the amount produced matches consumer demand.

Q1: Based on the preceding information,what amount will

Q31: Based on the preceding information,what amount of

Q31: Based on the preceding information,what amount will

Q35: Based on the preceding information,in the eliminating

Q36: Based on the information provided,what is the

Q47: One problem with Ebbinghaus's studies was:<br>A)he did

Q47: Missoula Corporation disposed of one of its

Q49: Which neurotransmitter increases attention and concentration?<br>A)serotonin<br>B)epinephrine<br>C)histamine<br>D)glycine

Q52: Based on the preceding information,Trevor Company's net

Q82: Bonita believes we learn about the mind