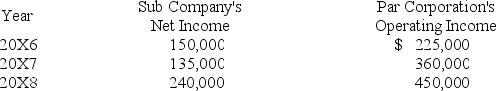

Sub Company sells all its output at 20 percent above cost to Par Corporation.Par purchases its entire inventory from Sub.The incomes reported by the companies over the past three years are as follows:

Sub Company sold inventory for $300,000,$262,500 and $337,500 in the years 20X6,20X7,and 20X8 respectively.Par Company reported ending inventory of $105,000,$157,500 and $180,000 for 20X6,20X7,and 20X8 respectively.Par acquired 70 percent of the ownership of Sub on January 1,20X6,at underlying book value.The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Sub Company sold inventory for $300,000,$262,500 and $337,500 in the years 20X6,20X7,and 20X8 respectively.Par Company reported ending inventory of $105,000,$157,500 and $180,000 for 20X6,20X7,and 20X8 respectively.Par acquired 70 percent of the ownership of Sub on January 1,20X6,at underlying book value.The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

-Based on the information given above,what will be the consolidated net income for 20X6?

Definitions:

Stone Instrument

A tool made of stone, typically used in historical or prehistoric contexts for various purposes, such as cutting, pounding, or as part of a ritual.

Skull

The bony structure forming the head, protecting the brain and supporting the structures of the face.

Functional Behavior

Behavior that is considered pragmatic and adaptive, helping individuals to achieve goals efficiently in their environment.

Abnormality

A deviation from the average or norm that may indicate a pathology or condition requiring attention or treatment.

Q1: Based on the preceding information,in the preparation

Q3: Assume Shove sold the inventory to Push.<br>Using

Q6: The items below are associated with the

Q8: Based on the information given above,in the

Q16: Sets of statements devised to explain a

Q34: Infinity Corporation acquired 80 percent of the

Q37: Based on the preceding information,on Leo's consolidated

Q40: Based on the preceding information,what amount of

Q50: What is the ending balance in noncontrolling

Q79: Training an individual to respond differently to