The following information applies to Questions 21-26

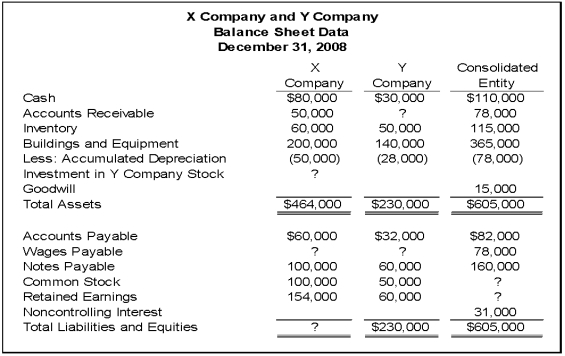

On December 31, 20X8, X Company acquired controlling ownership of Y Company. A consolidated balance sheet was prepared immediately. Partial balance sheet data for the two companies and the consolidated entity at that date follow:

During 20X8, X Company provided consulting services to Y Company and has not yet paid for them. There were no other receivables or payables between the companies at December 31, 20X8.

-Rohan Corporation holds assets with a fair value of $150,000 and a book value of $125,000 and liabilities with a book value and fair value of $50,000.What balance will be assigned to the noncontrolling interest in the consolidated balance sheet if Helms Company pays $90,000 to acquire 75 percent ownership in Rohan and goodwill of $20,000 is reported?

Definitions:

Short-Term Debt

Loans or borrowings that are due for repayment within a short timeframe, typically within one year, used for immediate financing needs.

Retained Earnings

The portion of net income not distributed as dividends to shareholders, but retained by the company for reinvestment.

MACRS 3-Year Class

A category under the Modified Accelerated Cost Recovery System (MACRS) for depreciating certain types of business property over three years.

Amortized

Amortization is the process of spreading out a loan into a series of fixed payments over time, covering both principal and interest.

Q4: Based on the information given above,what amount

Q13: Describe the advantages and disadvantages to using

Q17: Refer to the information provided above.David directly

Q19: Pro forma disclosures are:<br>A)used to disclose unscheduled

Q19: Based on the information provided,income to the

Q20: Upon arrival in Chile,Karen exchanged $1,000 of

Q28: Which of the following acts requires that

Q28: Based on the preceding information,what amount of

Q37: Based on the information given,what amount will

Q39: Based on the preceding information,what amount of