USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

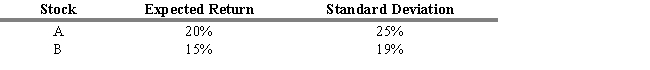

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the expected return of the stock A and B portfolio?

Definitions:

Illusory Correlation

The belief in a connection between two variables even when there is actually no such connection present.

Beginner's Luck

The phenomenon where an inexperienced person achieves success in a particular activity on their first try.

Internal-Unstable

This term is not standard; please provide context or it might be incorrect.

External-Unstable

An attributional style where individuals attribute their successes or failures to external, temporary factors.

Q1: In his original article, Fama divided the

Q4: Operating free cash flow and free cash

Q16: A "runs test" on successive stock price

Q22: In one of their empirical tests of

Q22: Structural changes occur when the economy undergoes

Q25: Most technicians feel that since price patterns

Q30: In the rapid accelerating growth stage, profit

Q67: Refer to Exhibit 5-4. What is the

Q68: Refer to Exhibit 3-1. What is the

Q85: Refer to Exhibit 9-8. Calculate the present