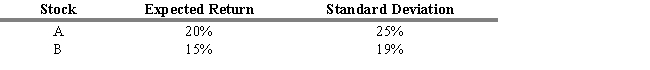

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the standard deviation of the stock A and B portfolio?

Definitions:

Manager

An individual responsible for planning, directing, and overseeing the operations and fiscal health of a business unit, department, or an organization.

Key Realities

Fundamental truths or facts that are crucial for understanding or addressing specific situations, issues, or contexts within an organization or discipline.

Small Business

An enterprise characterized by smaller staff numbers and lower revenue compared to larger corporations, often privately owned and operated.

Entrepreneurship Career Options

The various pathways and opportunities available for individuals pursuing careers in creating, managing, and developing new businesses or ventures.

Q19: Between 1998 and 2008, the standard deviation

Q25: Refer to Exhibit 1-8. Calculate the HPY

Q30: Refer to Exhibit 9-8. Calculate the present

Q35: What is the expected return of

Q40: Bond ratings are positively related to<br>A) Leverage.<br>B)

Q61: What purpose does a final project report

Q69: The best way to directly acquire the

Q77: The most import criteria when adding new

Q81: Given Birdchip's beta of 1.25 and a

Q100: The existence of transaction costs indicates that