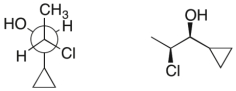

Identify the relationship between these two structures.

Definitions:

Market Risk Premium

The additional return expected by investors for taking on the risk of investing in the stock market over a risk-free asset.

Stock Beta

A measure of a stock's volatility in comparison to the overall market. A beta higher than 1 implies greater volatility.

Risk-free Interest Rate

The theoretical return of an investment with no risk of financial loss, typically represented by government bonds.

Portfolio Beta

An indicator of the level of systematic risk or volatility in a portfolio relative to the overall market.

Q1: What is the IUPAC name for the

Q31: What is wrong with the following mechanism?

Q68: In a Brønsted-Lowry acid-base reaction, the reactants

Q78: What is the formal charge on the

Q79: Identify the compound that would react most

Q92: What is the percentage of the S

Q93: Draw an energy diagram for a concerted

Q95: Draw the conjugate base of CH<sub>3</sub>CH<sub>2</sub>NH<sub>2</sub>.

Q116: Based upon the following energy diagram, is

Q151: Draw the mechanism and product for the