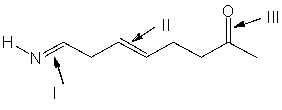

Rank absorption of the indicated bonds in decreasing (highest to lowest) order of wavenumber.

Definitions:

Permanent Differences

Differences between taxable income and accounting income that arise due to items recognized in one manner for accounting purposes and in another manner for tax purposes, and they do not reverse over time.

Permanent Differences

Differences between taxable income and accounting income that originate in one period and do not reverse over time, affecting the effective tax rate.

Temporary Differences

Temporary differences are differences between the carrying amount of an asset or liability in the balance sheet and its tax base, leading to deferred tax assets or liabilities.

Taxable Income

Taxable income is the amount of income used to calculate how much tax an individual or a company owes to the government in a given tax year.

Q6: Provide the product for the following reaction.

Q8: Provide the structure for (S,E)-3-t-butyl-4-methyl-1,4-hexadiene.

Q31: Devise a method of converting acetylene into

Q69: Identify the changes that must occur in

Q75: Which of the following is true about

Q76: What reagents would best accomplish the following

Q87: Protons H<sub>a</sub> and H<sub>b</sub> in the following

Q90: Select the best reagents for the reaction

Q93: Provide a stepwise synthesis for the following.

Q118: Which of the following wavenumber corresponds to