Use the information below to answer the following question(s) .

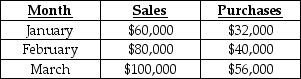

The following information pertains to Hepburn Company:

Cash is collected from customers in the following manner:

- Month of sale 30%

- Month following the sale 70%

40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.

Labour costs are 20% of sales. Other operating costs are $30,000 per month (including $8,000 of depreciation) . Both of these are paid in the month incurred. The cash balance on March 1 is $8,000. A minimum cash balance of $6,000 is required at the end of the month. Money can be borrowed in multiples of $1,000.

-How much cash will be disbursed in total in March?

Definitions:

Merchandise

Goods or products that are bought and sold in business.

Commission

A fee paid for services, usually a percentage of the total cost, to an agent or employee for facilitating a sale or other transaction.

Commission-only Basis

A compensation structure where earnings are solely made from commissions without a base salary.

Monthly Sales

The total revenue generated from sales activities within a specific month, often used to measure business performance.

Q16: Assuming the Sporty line is discontinued, total

Q27: Assume the transfer price for a pair

Q40: What is the Toy Division's Return on

Q53: What is the difference between relevant and

Q108: Cost distortion results in the<br>A) overcosting of

Q181: During the week, Hoster's potato chip manufacturing

Q219: What is Paulson Corporation's direct labour efficiency

Q224: Grandma's Touch Specialty Foods produces a specialty

Q240: The actual cost of direct materials is

Q247: Rockwell Corporation manufactures and sells computer keyboards.