Use the information below to answer the following question(s) .

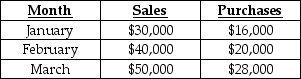

The following information pertains to Tiffany Company:

Cash is collected from customers in the following manner:

- Month of sale 30%

- Month following the sale 70%

40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.

Labour costs are 20% of sales. Other operating costs are $15,000 per month (including $4,000 of depreciation) . Both of these are paid in the month incurred. The cash balance on March 1 is $4,000. A minimum cash balance of $3,000 is required at the end of the month. Money can be borrowed in multiples of $1,000.

-How much cash will be disbursed in total in March?

Definitions:

Medical Expenses

Costs associated with the diagnosis, cure, mitigation, treatment, or prevention of disease, and expenses for treatments affecting any part of the body, potentially tax-deductible.

Deductible

An expense that can be subtracted from adjusted gross income to reduce taxable income, thereby lowering tax liability.

Investment Interest Expense

Interest paid on money borrowed to purchase or held for investment purposes, which can be deducted to reduce taxable income under certain conditions.

Net Investment Income

The income received from investment assets (like stocks and bonds) after expenses associated with making the investment are deducted.

Q19: Define operating budgets and financial budgets. List

Q38: What is the technique called that asks

Q70: Total manufacturing costs for part A is<br>A)

Q89: The _ variance is the difference between

Q109: In setting regular sales prices it does

Q152: Absorption costing should be used when making

Q161: During April, Gordon Company had actual sales

Q167: The Hotel Division of Treasure Island Corporation

Q190: Different management levels in Bates Inc. require

Q224: Grandma's Touch Specialty Foods produces a specialty