Use the information below to answer the following question(s) :

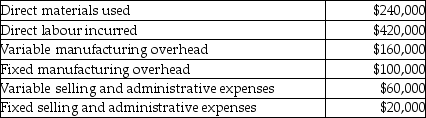

Venus Corporation provided the following information regarding its single product:

The regular selling price for the product is $75. The annual quantity of units produced and sold is 20,000 units (the costs above relate to the 20,000 units production level) . There was no beginning inventory.

-What would be the effect on Venus Corporation's operating income of accepting a special order for 3,000 units at a sale price of $65 per product? The company has excess capacity and regular sales will not be affected by this special order.

Definitions:

Convertible Debt

A type of bond or loan that can be converted into a predetermined amount of the company's equity, usually at the discretion of the debt holder.

LIFO Inventory

An inventory valuation method (Last In, First Out) where the most recently produced or acquired items are the first to be expensed as cost of goods sold, affecting the company's books during periods of inflation.

Bank Overdraft

A facility allowing a bank account holder to withdraw more money than is actually in their account, often used for short-term financing.

IFRS

International Financial Reporting Standards, which are a set of accounting standards developed by the International Accounting Standards Board that guide how financial transactions and other accounting events should be reported in financial statements.

Q43: The Simcoe Company is in the process

Q49: It is easier to allocate indirect costs

Q109: The production volume variance is the difference

Q131: Irvin Racquet Company produces tennis racquets. The

Q151: When making any sort of decision, managers

Q167: SuperOffice Company expects its November sales to

Q178: Traditional single-allocation-base cost systems tend to over-cost

Q181: The "total physical units to account for"

Q202: Latimer Corporation collects 35% of a month's

Q239: If a worker drops the raw material