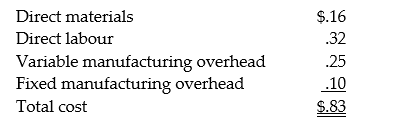

The Shoop Corporation produces and sells a part used in the production of tractors. The unit costs associated with this part are as follows:

Jupiter Company has approached Shoop Corporation with an offer to purchase 20,000 units of this part at a price of $.72. Accepting this special sales order will put idle manufacturing capacity to use and will not affect regular sales. Total fixed costs will not change.

Determine whether or not the special order should be accepted. Justify your conclusion.

Definitions:

Produced Units

The total number of units manufactured within a specific period.

Direct Manufacturing Cost

The total of direct materials and direct labor costs that are tied directly to the production process of a product.

Produced Units

The aggregate quantity of units produced over a defined time frame.

Relevant Range

The scope of business activity levels for which certain cost assumptions and behaviors remain valid.

Q4: Stillwater Corporation manufactures outdoor planters. Budgeted sales

Q6: What is the direct labour price variance

Q10: The estimated total manufacturing overhead costs that

Q14: What are the Samson Company total cash

Q29: High Rise Display Company manufactures display cases

Q40: Using a departmental overhead rate reduces the

Q111: A system for assigning costs for products

Q134: Companies often refine their cost allocation systems

Q135: Lisbon Company's budgeted data for the upcoming

Q152: A cost centre is a responsibility centre