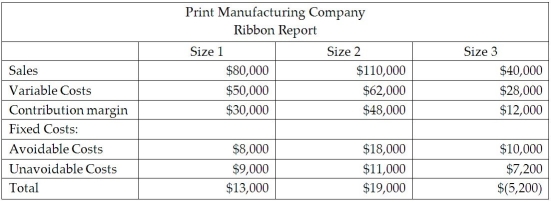

The Print Manufacturing Company manufactures Size 1, Size 2, and Size 3 printer ribbons to support the printers it manufactures. The managerial accountant reported the following information:

The managerial accountant at Print Manufacturing noted that the Size 3 printer ribbon reports a loss and the managerial accountant needs to determine if the company should drop the Size 3 printer ribbon. What is the increase or decrease in operating income if the operations manager drops the Size 3 printer ribbon and does not replace it? If the managerial accountant recommends that the organization drop the Size 3 printer ribbon and rent out the space the company uses to store the product at $11,000 per year, is there an increase or a decrease in operating income?

Definitions:

Current Tax Liability

The amount of income taxes a company is obligated to pay within the next year.

Accounting Standards

Authoritative standards and principles that guide financial accounting and reporting practices for businesses and organizations.

Deferred Tax Item

An accounting concept representing a future tax liability or asset, resulting from temporary differences between the carrying amount of an asset or liability in the balance sheet and its tax base.

Q1: Companies that use departmental overhead rates trace

Q11: Each month, Tuttle Corporation produces 400 units

Q44: Activity-based costing considers _ to be the

Q50: Inspection is considered a value-added activity.

Q58: The operating budgets of retailers and manufacturers

Q120: Gas Country is considering selling premium gasoline.

Q143: Value-added activities are<br>A) also called waste activities.<br>B)

Q171: What is the direct manufacturing labour efficiency

Q207: Lacy's Department Store has budgeted cost of

Q240: Which of the following is the factor