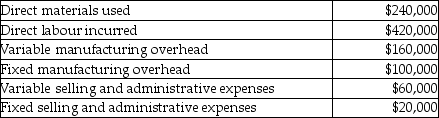

Use the information below to answer the following question(s) :

Pluto Incorporated provided the following information regarding its single product:

The regular selling price for the product is $80. The annual quantity of units produced and sold is 40,000 units (the costs above relate to the 40,000 units production level) . There was no beginning inventory.

-What would be the effect on operating income of accepting a special order for 1,000 units at a sale price of $40 per product? The special order units would not require any variable selling and administrative expenses. The company has excess capacity and regular sales will not be affected by this special order.

Definitions:

SEC

The U.S. Securities and Exchange Commission, a federal agency responsible for enforcing federal securities laws and regulating the securities industry.

CPA

Certified Public Accountant, a professional designation given to accountants who pass a licensing examination and meet other state requirements.

IRS

The Internal Revenue Service, the U.S. federal agency responsible for tax collection and enforcement of tax laws.

Owner's Equity

The residual interest in the assets of an entity after deducting liabilities; essentially the net worth belonging to the owners.

Q26: What is the ending cash balance for

Q27: Tuscany Foods has the following information about

Q35: How many mattresses need to be produced

Q48: Rackets Ltd. manufactures two models of badminton

Q126: Which of the following budgets is not

Q144: How is the flexible budget quantity of

Q199: What would be the effect on Venus

Q202: Heather's Pillow Company manufactures pillows. The current

Q202: Latimer Corporation collects 35% of a month's

Q257: In process costing, the manufacturing costs assigned