Use the information below to answer the following question(s) :

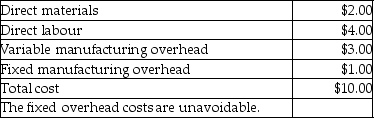

Spahr Company produces a part that is used in the manufacture of one of its products. The unit manufacturing costs of this part, assuming a production level of 5,000 units, are as follows:

-Assuming no other use for its facilities, what is the highest price per unit that Spahr Company should be willing to pay for the part?

Definitions:

Federal Government Spending

Expenditures by the federal government on goods, services, and obligations, including defense, welfare, and public works.

Federal Income Tax

A tax levied by the U.S. federal government on individuals and entities based on their annual income, with rates that vary by income level.

Payroll Tax

A tax imposed on employers and employees, calculated as a percentage of the wages that employers pay their staff.

Federal Receipts

Revenue collected by the federal government, generally through taxes and fees.

Q3: Which of the following would use process

Q85: What is the cost per equivalent unit

Q95: Variable costs are relevant to a special

Q106: Lisbon Company's budgeted data for the upcoming

Q127: Good Looks Fitness operates a large fitness

Q136: What is the variable overhead spending variance?<br>A)

Q147: An example of a constraint for expansion

Q174: What are the total equivalent units for

Q186: When units are moved from one processing

Q215: A budget is a qualitative expression of