Use the information below to answer the following question(s) :

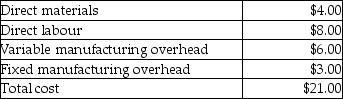

Star Appliance manufactures a variety of appliances which all use Part 92F. Currently, Star Appliance manufactures Part 92F itself. It has been producing 8,000 units of Part 92F annually. The annual costs of producing Part 92F at the level of 8,000 units include:

All of the fixed manufacturing overhead costs would continue whether Part 92F is made internally or purchased from an outside supplier. Star Appliance has no alternative use for the manufacturing facilities.

-Roger Parts Company has offered to sell 8,000 units of Part 92F to Star Appliance for $22.00 per unit. What is the highest price per unit that Star Appliance should be willing to pay for the part?

Definitions:

Cost Accounting

is a process of recording, classifying, analyzing, and allocating all costs associated with the production process to evaluate financial performance.

Capital Budgeting

The process by which a business evaluates and selects long-term investments that are worth more than their cost to achieve strategic goals.

Cash Flows

The total amount of money being transferred into and out of a business, which affects the company's liquidity.

Initial Cost

The upfront expenditure related to acquiring or starting a new project or investment, not including ongoing or future costs.

Q20: Service companies prepare a cash budget.

Q36: Assuming no other use for its facilities,

Q43: Signs that a product cost system is

Q64: Machine set-up would most likely be classified

Q73: When a company uses direct materials, the

Q95: Variable costs are relevant to a special

Q110: Brittany Furniture manufactures two products, pillows and

Q144: The number of equivalent units for vitamins

Q161: Sustainability and lean thinking are both important

Q237: On December 31, what is the total