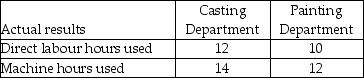

The Braveheart Corporation uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: cutting and painting. The Cutting Department uses a departmental overhead rate of $12 per machine hour, while the Painting Department uses a departmental overhead rate of $17 per direct labour hour. Job 422 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $20 per direct labour hour and the cost of the direct materials used by Job 422 is $800.

Required: What was the total cost of Job 422 if the Braveheart Corporation used the departmental overhead rates to allocate manufacturing overhead?

Definitions:

Straight-Line Method

A depreciation technique that allocates an equal amount of the asset's cost to each year of its useful life.

Semiannually

Occurring twice a year; a term often used to describe the payment schedule of interest or dividends.

Amortization of Discount

The gradual reduction of a bond discount over its life, affecting the issuer's interest expense and balance sheet.

Q63: ABC produces ping-pong balls using a three-step

Q76: Why are the benefits of adopting ABC/ABM

Q81: Using a cost-plus approach, what price should

Q90: A departmental overhead rate is calculated by

Q128: The predetermined overhead allocation rate using the

Q177: The last step of the 5-step process

Q202: Latimer Corporation collects 35% of a month's

Q243: Companies that use automated production processes often

Q252: Conversion costs are generally added evenly throughout

Q349: Which of the following is an example