Use the information below to answer the following question(s) :

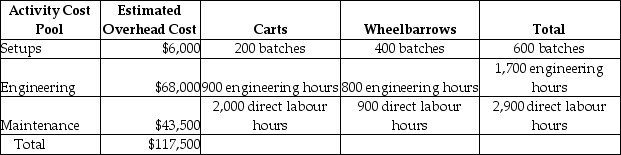

Vittoria Corporation manufactures two products-Carts and Wheelbarrows. The annual production and sales of Carts is 2,000 units, while 1,800 units of Wheelbarrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Carts require 1.0 direct labour hours per unit, while Wheelbarrows require 0.5 direct labour hours per unit. The total estimated overhead for the period is $117,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The predetermined overhead allocation rate using the traditional costing system would be closest to

Definitions:

Producer Surplus

The difference between what producers are willing to sell a good for and the actual price they receive, representing their gain.

Firm's Willingness

Refers to a company's readiness to engage in activities like selling at certain prices or producing specific quantities.

Willingness to Pay

The maximum amount an individual is prepared to sacrifice to procure a good or service or to avoid something undesirable.

Economic Signals

Indicators or signs used by consumers and producers to guide their actions, such as prices, which indicate when to buy or sell products or resources.

Q79: Natural Desserts has 2,500 gallons of paint

Q85: What is the cost per equivalent unit

Q86: The total number of physical units for

Q93: What is the cost of assembling per

Q160: The allocation rate for machine setups is<br>A)

Q164: Which of the following types of cash

Q191: The costing system used by a company

Q197: Which of these documents informs the storeroom

Q235: Which of the following best describes an

Q263: Forge Company produces cast-iron skillets. A local