Use the information below to answer the following question(s) :

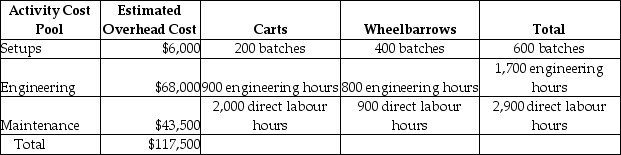

Vittoria Corporation manufactures two products-Carts and Wheelbarrows. The annual production and sales of Carts is 2,000 units, while 1,800 units of Wheelbarrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Carts require 1.0 direct labour hours per unit, while Wheelbarrows require 0.5 direct labour hours per unit. The total estimated overhead for the period is $117,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The cost pool activity rate for engineering costs would be closest to

Definitions:

Expense Matching

An accounting principle that states expenses should be recorded in the same period as the revenues they helped to generate, to accurately match income with expenses.

Cause and Effect

A relationship where one event (the cause) leads to the outcome of another event (the effect).

Systematic Allocation

The methodical distribution of costs or revenues across different accounts, periods, or projects to match expenses with related revenues.

Expense Recognition

The accounting principle dictating that expenses are recorded when incurred, not necessarily when paid.

Q19: In a process system with multiple processes,

Q57: DataSave is a manufacturer of USB Flash

Q61: What is the total cost of units

Q87: If Clear Sky Sailmakers accepts a special

Q111: Fixed costs that exist even after a

Q155: On December 31, the total cost of

Q170: Cost-plus price minus desired profit equals total

Q183: What is the cost per driver unit

Q190: Assuming Spahr Company can purchase 5,000 units

Q228: If all direct materials are added at