Use the information below to answer the following question(s) :

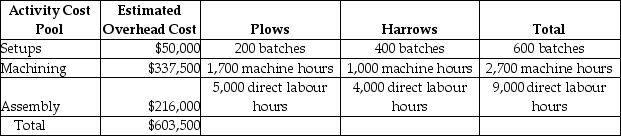

Martin Corporation manufactures two products-Plows and Harrows. The annual production and sales of Plows is 1,000 units, while 2,000 units of Harrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Plows require 5.0 direct labour hours per unit, while Harrows require 2.0 direct labour hours per unit. The total estimated overhead for the period is $603,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The cost pool activity rate for Machining Costs would be closest to

Definitions:

Q5: The benefits of adopting ABC/ABM are higher

Q18: Total direct materials equals $90,000, and there

Q31: Assuming Star Appliance can purchase 8,000 units

Q36: What was the total PRE-OP cost for

Q41: How much of the correspondence cost will

Q53: To find the "cost per equivalent unit,"

Q71: Assume that factory space freed up by

Q94: If $25,000 of fixed costs will be

Q125: Mabel has the following information to evaluate

Q169: A decision must be made at the