Use the information below to answer the following question(s) :

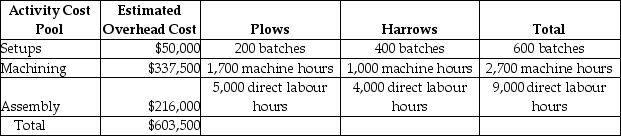

Martin Corporation manufactures two products-Plows and Harrows. The annual production and sales of Plows is 1,000 units, while 2,000 units of Harrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Plows require 5.0 direct labour hours per unit, while Harrows require 2.0 direct labour hours per unit. The total estimated overhead for the period is $603,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The overhead cost per harrow using an activity-based costing system would be closest to

Definitions:

Co-branding

A marketing strategy involving the collaboration between two or more brands to create a product or service that leverages the strengths and market appeal of each brand.

Co-brand

A marketing strategy where two or more brands collaborate on a product or service to leverage each other's brand equity and reach.

Luxury Status

The prestige or esteem that comes from owning or using high-end, quality, and often expensive products that symbolize exclusivity and sophistication.

Q13: Companies that use ABC trace direct materials

Q18: ABC costing is generally more accurate than

Q76: Natural Desserts has 2,500 gallons of paint

Q132: Managers should consider the potential long-run effect

Q140: The entry to record actual manufacturing overhead

Q165: At Madson Distillery the company uses the

Q178: Soft Shell purchases motorcycle helmets which it

Q183: ABC produces ping-pong balls using a three-step

Q199: The key to allocating indirect manufacturing costs

Q250: At Alexandria Corporation, what are the equivalent