Use the information below to answer the following question(s) :

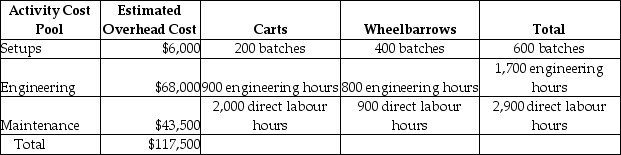

Vittoria Corporation manufactures two products-Carts and Wheelbarrows. The annual production and sales of Carts is 2,000 units, while 1,800 units of Wheelbarrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Carts require 1.0 direct labour hours per unit, while Wheelbarrows require 0.5 direct labour hours per unit. The total estimated overhead for the period is $117,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The predetermined overhead allocation rate using the traditional costing system would be closest to

Definitions:

Retained Earnings

The portion of net income that is not distributed to shareholders and is instead reinvested in the company.

Shareholders' Equity

The residual interest in the assets of a corporation after deducting liabilities, representing the owners' claim on the company's assets.

Financial Statement

A record that details the financial activities and condition of a business, person, or other entity.

Accounts

Financial records of an entity that detail transactions and can be used to prepare financial statements.

Q4: The departmental manufacturing overhead rate for the

Q69: Green Valley golf course is planning for

Q70: The first-in, first-out process-costing method assumes that

Q81: Using a cost-plus approach, what price should

Q119: What are the total cash collections in

Q186: When units are moved from one processing

Q209: A company uses a process system. The

Q226: In a process costing environment, direct labour

Q254: Assuming the Sporty line is discontinued, total

Q264: A company manufactures organic juices. Last month's