Use the information below to answer the following question(s) :

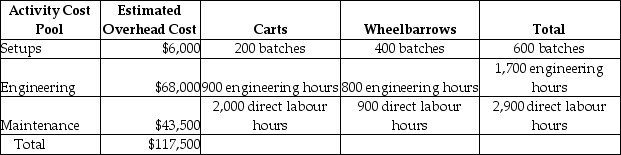

Vittoria Corporation manufactures two products-Carts and Wheelbarrows. The annual production and sales of Carts is 2,000 units, while 1,800 units of Wheelbarrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Carts require 1.0 direct labour hours per unit, while Wheelbarrows require 0.5 direct labour hours per unit. The total estimated overhead for the period is $117,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The overhead cost per Wheelbarrow using the traditional costing system would be closest to

Definitions:

Specialty Products

Specialty products are goods or services that have unique characteristics and are significant to buyers, who therefore often spend considerable time and effort in making purchase decisions.

R&D Team

A group of specialists working on research and development tasked with innovating and creating new products or improving existing ones.

Q16: At Pizza Company the cost per equivalent

Q20: Service companies prepare a cash budget.

Q30: When used, raw materials<br>A) would be classified

Q78: All of the following are activities in

Q91: Assuming the Fashion line is discontinued, total

Q107: Transferred-in costs are incurred in a previous

Q157: Total units costs for all parts is<br>A)

Q198: What types of businesses can use a

Q238: On December 31, the cost per equivalent

Q280: At Brooks Corporation the total cost of