Use the information below to answer the following question(s) :

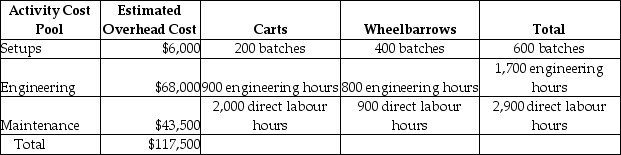

Vittoria Corporation manufactures two products-Carts and Wheelbarrows. The annual production and sales of Carts is 2,000 units, while 1,800 units of Wheelbarrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Carts require 1.0 direct labour hours per unit, while Wheelbarrows require 0.5 direct labour hours per unit. The total estimated overhead for the period is $117,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The overhead cost per Wheelbarrow using an activity-based costing system would be closest to

Definitions:

Reflect Opinion

To show, represent, or express the views, attitudes, or sentiments of individuals or groups.

Inventory Turnover

A ratio indicating how often a company sells and replaces its stock of goods during a particular period, a measure of efficiency in managing inventory.

Current Ratio

Indicates the extent to which current liabilities are covered by those assets expected to be converted to cash in the near future; it is found by dividing current assets by current liabilities.

Obsolete

Refers to products, technologies, or methods that are out-of-date, no longer usable, or have been replaced by new versions.

Q71: Baoding mass-produces a single product using three

Q101: Wisteria Company is debating the use of

Q125: Mabel has the following information to evaluate

Q158: In a process costing system with a

Q181: The "total physical units to account for"

Q196: If the Garrett Company allocates overhead based

Q208: A transfer of $24,000 from the assembly

Q260: Clean Air is a manufacturer of dust

Q264: The contribution margin per unit of constraint

Q276: Direct materials are usually added evenly throughout