Use the information below to answer the following question(s) :

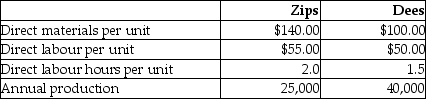

Kepple Manufacturing currently uses a traditional costing system. The company allocates overhead to its two products, Zips and Dees, using a predetermined manufacturing overhead rate based on direct labour hours. Here is data related to the company's two products:

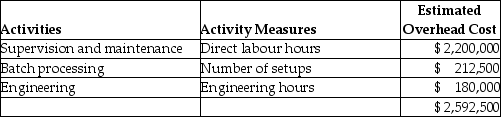

Information about the company's estimated manufacturing overhead for the year follows:

Information about the company's estimated manufacturing overhead for the year follows:

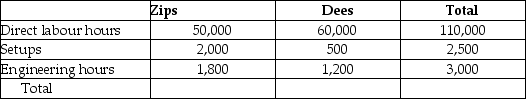

Additional information about production needed for the activity-based costing system follows:

Additional information about production needed for the activity-based costing system follows:

Expected Activity

-The amount of manufacturing overhead that would be allocated to one unit of Zips using an activity-based costing system would be closest to

Definitions:

Fiscal Period

A specific time period for which a company prepares financial statements, typically a year or quarter.

Adjusted Trial Balance

A list of all accounts and their final balances after adjustments, used to prepare financial statements.

Income Summary Account

A temporary account used to accumulate all income and expense accounts before transferring the net amount to retained earnings at the end of an accounting period.

Retained Earnings

The portion of net earnings not distributed as dividends to shareholders, but retained by the company to be reinvested in its core business or to pay debt.

Q4: If Champion Parts can eliminate fixed costs

Q43: Signs that a product cost system is

Q62: The weighted-average method of process costing is

Q63: Which of the following condition(s) favours using

Q85: Which of the following budgets is not

Q100: Each morning, Max Imery stocks the drink

Q168: Manufacturing, merchandising, and service companies prepare operating

Q255: What are the total equivalent units for

Q261: Calculate the equivalent units for conversion costs

Q302: Which of the following would be appropriately