Use the information below to answer the following question(s) :

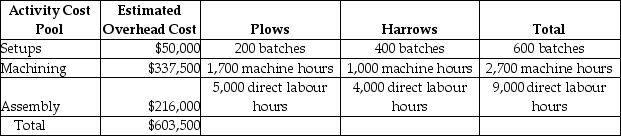

Martin Corporation manufactures two products-Plows and Harrows. The annual production and sales of Plows is 1,000 units, while 2,000 units of Harrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Plows require 5.0 direct labour hours per unit, while Harrows require 2.0 direct labour hours per unit. The total estimated overhead for the period is $603,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The overhead cost per Harrow using the traditional costing system would be closest to

Definitions:

Depreciation

The accounting entry allocating the cost of a long-lived asset against income over the asset’s life. Depreciation is a noncash charge, so net income is generally less than true cash flow by at least the amount of depreciation.

Opportunity Costs

The cost of foregoing the next best alternative when making a decision.

Financing Costs

Expenses a company pays to borrow funds or raise capital through equity, including interest payments, fees, and other charges.

Depreciation Costs

The allocation of the cost of an asset over its useful life, reflecting the decrease in value due to wear and use.

Q29: High Rise Display Company manufactures display cases

Q49: The Gameshop manufactures specialized board games. Management

Q81: Using a cost-plus approach, what price should

Q106: An example of an industry that uses

Q139: The Assembly Department of Zoom Auto Parts

Q178: Management accountants gather and analyze relevant information

Q183: ABC produces ping-pong balls using a three-step

Q217: The managerial accountant at the Holly and

Q284: Computing the predetermined manufacturing overhead rate is

Q302: Which of the following would be appropriately