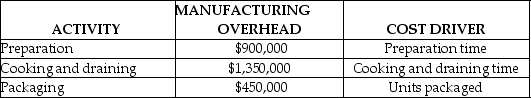

Clucker Chicken produces several styles of precooked and package chicken wings (drums,

tips, buffalo and coated with a variety of spices and sauces). Each style of wing requires different

preparation time, different cooking and draining times and different packaging. Therefore

the company management has decided to try ABC costing to better capture the manufacturing

overhead costs incurred by each style of wing. The following activities related to yearly

manufacturing overhead costs and cost drivers have been identified:

Compute the activity cost allocation rates for each activity assuming the following total estimated activity for the year: 45,000 hours preparation time, 45,000 cooking and draining hours, and 9,000,000 packages.

Definitions:

Annual Payroll

The total amount of wages, salaries, bonuses, and other compensation paid by a business to its employees over a year.

Business Days

Days of the week excluding weekends and public holidays, typically Monday through Friday, when business operations are conducted.

Fixed Charge Coverage

A financial metric evaluating how well a company can pay off its fixed expenses, like interest and leases, using its earnings before interest, taxes, depreciation, and amortization (EBITDA).

Times Interest Earned Ratio

A measure of a company's ability to meet its interest obligations, calculated as earnings before interest and taxes divided by interest expense.

Q32: What are the Samson Company cash disbursements

Q45: Management by exception directs management's attention to

Q58: The operating budgets of retailers and manufacturers

Q83: Sweet Stuff Bakery mass-produces cakes using three

Q118: Using factory utilities would most likely be

Q144: What would be the effect on operating

Q161: Record the following process costing transactions in

Q221: Fixed costs can affect product mix considerations.

Q227: If all direct materials are added at

Q240: Job costing is used by companies that