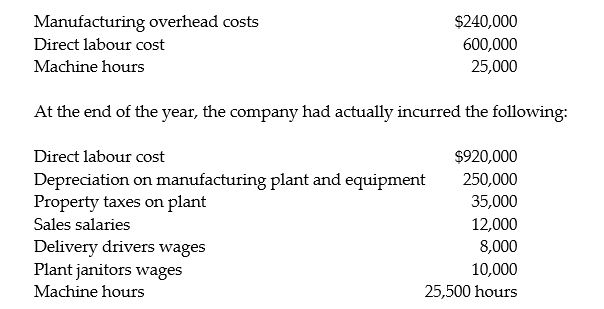

Sambell Manufacturing uses a predetermined manufacturing overhead rate to allocate overhead to individual jobs. At the beginning of the year, the company expected to incur the following:

Required:

1. Compute Sambell's indirect cost allocation rate based on labour cost.

2. Compute Sambell's indirect cost allocation rate based on machine hours.

3. How much overhead was allocated during the year if the allocation base was direct labour cost?

4. How much manufacturing overhead was incurred during the year?

Definitions:

Fixed Overhead Budget Variance

The variance between the budgeted and the actual incurred fixed overhead expenses.

Manufacturing Overhead Applied

The portion of estimated manufacturing overhead cost that is assigned to each unit of production based on a predetermined rate.

Labor-Hour

A labor-hour represents an hour of work performed by an employee, typically used as a basis for allocating labor costs or measuring productivity.

Manufacturing Overhead

All indirect costs associated with the manufacturing process, including but not limited to utilities, maintenance, and factory equipment depreciation.

Q26: In process costing the Work in Process

Q30: If a company has a series of

Q55: Which of the following is the most

Q65: Funky Corporation management has budgeted the following

Q146: Dudley & Spahr, Attorneys at Law, provide

Q149: On December 31, the cost per equivalent

Q205: What is the margin of safety in

Q241: A local attorney employs ten full-time professionals.

Q250: If the contribution margin ratio is 32%,

Q262: The entry at Callor Corporation to record