Use the information below to answer the following question(s) .

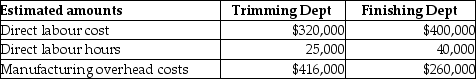

Solid Oak Bureau Company uses job costing. Solid Oak Bureau Company has two departments, Trimming and Finishing. Manufacturing overhead is allocated based on direct labour cost in the Trimming Department and direct labour hours in the Finishing Department. The following additional information is available:

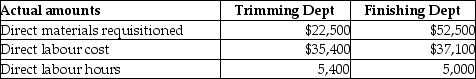

Actual data for completed Job No. 650 is as follows:

-What is the predetermined manufacturing overhead rate for the Trimming Department?

Definitions:

General Journal

An accounting book where all transactions are initially recorded, based on the double-entry bookkeeping system, before being transferred to specific accounts.

Accounts Receivable

Company receivables from goods or services provided to customers that remain unpaid.

Accounts Payable

Debts or financial obligations to vendors or lenders for products and services that have been acquired but remain unpaid.

Office Equipment

Office Equipment refers to the assets purchased for use in a business office, which may include computers, printers, furniture, and more, aiding in operational efficiencies.

Q4: Total variable costs change in direct proportion

Q42: The existence of ending work in process

Q62: What is the contribution margin for the

Q116: If all other factors are constant, any

Q136: Finished goods inventory is credited when the

Q190: At Clyde Company what would the predetermined

Q207: Here are selected data for Anthony Corporation:

Q257: What is the break-even point in units

Q306: At Smith Paints the predetermined manufacturing overhead

Q350: Which of the following entries would be