Use the information below to answer the following question(s) .

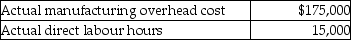

Before the year began, Johnson Manufacturing estimated that manufacturing overhead for the year would be $160,000 and that 12,000 direct labour hours would be worked. Actual results for the year included the following:

-At Johnson Manufacturing the amount of manufacturing overhead allocated for the year based on direct labour hours would have been

Definitions:

Noncontrolling Interest

The portion of equity (ownership) interest in a subsidiary not attributable to the parent company.

Intra-Entity Asset Transfers

Transactions involving the transfer of assets between divisions or units within the same company.

Net Income

Company's earnings following the deduction of all expenses and taxes from its revenue.

Intra-Entity Asset Transfers

Transactions involving the transfer of assets between divisions or departments within the same entity, often for internal record-keeping and consolidation purposes.

Q12: Samson Company currently sells its products for

Q38: Here is some basic data for Sarasota

Q56: PD Company has re-engineered its production process

Q86: The total number of physical units for

Q104: What is the total cost of units

Q106: When using the contribution margin ratio, managers

Q160: What is the predetermined manufacturing overhead rate

Q173: If Sable Company uses direct labour cost

Q176: The journal entry to record the use

Q251: Hollinger Ceramics makes custom ceramic tiles. During