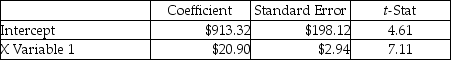

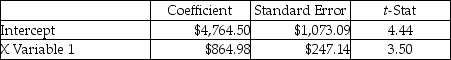

Pam's Stables used two different independent variables (trainer hours and number of horses) in two different equations to evaluate the cost of training horses. The most recent results of the two regressions are as follows: Trainer's hours:

r2 = 0.56

Number of horses: r2 = 0.63

r2 = 0.63

What is the estimated total cost for the coming year if 16,000 trainer hours are incurred and the stable has 400 horses to be trained, based on the best cost driver?

Definitions:

Ending Inventory

The final value of goods available for sale at the end of an accounting period.

Lower of Cost

A method of inventory valuation where the inventory items are recorded at the lower of their original cost or the market value at the time of the financial statement preparation.

Net Realizable Value

The estimated selling price of goods, minus the cost of their sale or completion.

Ending Inventory

The final value of goods available for sale at the end of an accounting period, calculated before the next period's beginning inventory.

Q10: What is the monthly margin of safety

Q20: American Corporation currently sells its products for

Q24: Average costing should be used to forecast

Q47: Before these materials are used to manufacture

Q96: What is gross profit at Summerville Company?<br>A)

Q168: What is operating income at Summerville Company?<br>A)

Q260: The margin of safety percentage for Duncan

Q292: Revenue less cost of goods sold equals

Q316: If Toby prepares a traditional income statement

Q361: At Mountain Manufacturing if $200,000 of the