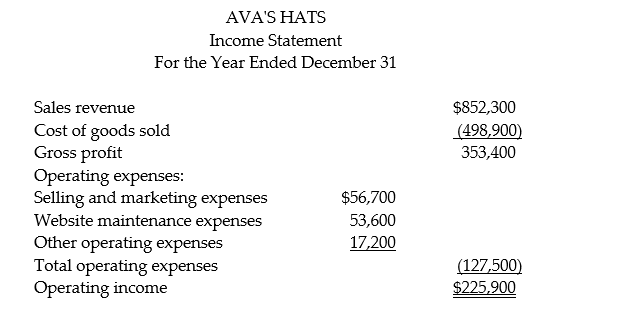

Ava's Hats is a small e-tail business specializing in the hand crocheted hats for infants and toddlers over the web. The business is owned by a sole proprietor and operated out of her home. Results for last year are as follows:

For internal planning and decision-making purposes, the owner of Ava's Hats would like to translate the company's income statement into the contribution margin format. Since Ava's Hats is an e-tailer, all of its cost of goods sold was variable. A large portion of the selling and marketing expenses consisted of freight-out charges ($16,500), which were also variable. Only 25% of the remaining selling and marketing expenses and 20% of the website expenses were variable. Of the other operating expenses, 90% were fixed.

Based on this information, prepare Ava's Hats' contribution margin income statement for last year.

Definitions:

FIFO Method

An inventory valuation method that assumes the first items placed into inventory are the first sold, thus expenses are based on the oldest costs.

Latest Goods On Hand

Refers to the most recent inventory of products or materials that a company has available for use or sale.

Lower-Of-Cost-Or-Market Basis

An accounting principle where inventory is recorded at either its historical cost or market value, whichever is lower, to ensure conservatism.

Conservatism

An accounting principle that requires potential expenses and liabilities to be recognized immediately, but revenue only when it is ensured.

Q9: At Vanco Industries, what is the variable

Q26: Using variable costing, what is the variable

Q87: The primary purpose of managerial accounting information

Q93: The Sarbanes-Oxley Act has significantly impacted the

Q97: Given break-even sales in units of 56,000

Q152: Ava's Needlework is a small e-tail business

Q196: The graph of a total variable cost

Q205: If Toby prepares a contribution margin income

Q221: Which of the following describes the way

Q235: Cost behaviour can be mathematically expressed using