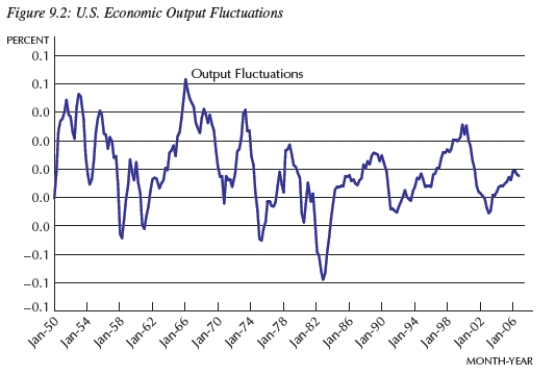

-Consider Figure 9.2.The line represents short-run fluctuations,

) Since 1950,the largest boom was in about __________ and the deepest recession was in about __________.

Definitions:

Portfolio Opportunity Set

The expected return–standard deviation pairs of all portfolios that can be constructed from a given set of assets.

Efficient Frontier

A portfolio optimization concept that plots the best possible return for a given level of risk based on various asset combinations.

Optimal Risky Portfolio

The optimal risky portfolio is the combination of risky assets that provides the highest expected return for a given level of risk or the lowest risk for a given level of expected return.

Risk Free Rate

The theoretical rate of return of an investment with zero risk, often represented by the yield on government securities like U.S. Treasury bonds.

Q28: The endogenous variables in the Solow model

Q37: Using Figure 7.1,which depicts the U.S.unemployment rate,which

Q40: Given the information in Table 10.2,this bank's

Q47: Consider Figure 9.2.In approximately which of the

Q53: Increasing returns to scale is characterized by:<br>A)constantly

Q75: In contrast to the dot-com stock market

Q77: If British incomes rose,this would be reflected

Q89: One of the main missions of the

Q90: Suppose that rather than the Cobb-Douglas production

Q94: To decompose what explains the difference in