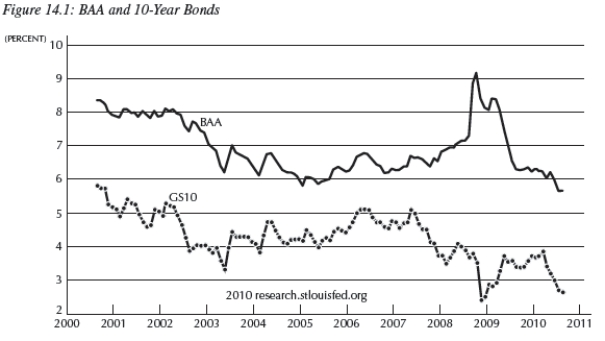

Use the figure below for the following questions;it shows the BAA corporate and 10-Year Treasury Bond yields.

-In Figure 14.1 above,the risk premium in late 2008 was about __________ percent.

Definitions:

Expiration Date

The date on which a derivative contract (like options or futures) becomes invalid and the right to exercise it ceases.

Indefinite Future

A time period in the future that has no defined ending or timeframe, often used in discussions about long-term possibilities or uncertainties.

Call Option

A financial contract that gives the holder the right, but not the obligation, to buy a specified amount of an underlying asset at a set price within a specified period.

Writer

In the context of options, the writer is the seller who grants the right to the buyer in exchange for a premium, assuming the risk that the asset may have to be delivered under the contract terms.

Q5: Consider Figure 11.2.If investment is interest rate

Q25: The government uses funds to:<br>A)make transfer payments.<br>B)buy

Q42: According to the Taylor rule,the federal funds

Q46: When economists say "sticky inflation," they mean

Q53: Throughout the first three-fourths or so of

Q64: If the economy grows faster than the

Q73: Defining <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4305/.jpg" alt="Defining As

Q76: In the intertemporal budget <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4305/.jpg" alt="In

Q80: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4305/.jpg" alt="If In

Q95: The Squam Lake Group's reform suggestions included: