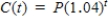

Suppose that the annual rate of inflation averages 4% over the next 10 years.With this rate of inflation,the approximate cost C of goods or services during any year in that decade will be given by  ,

,  where t is time in years and P is the present cost.If the price of an oil change for your car is presently $25.95,estimate the price 10 years from now.Round your answer to two decimal places.

where t is time in years and P is the present cost.If the price of an oil change for your car is presently $25.95,estimate the price 10 years from now.Round your answer to two decimal places.

Definitions:

Like-kind Exchange

A tax-deferred transaction allowing for the exchange of similar types of property without generating a tax liability from the sale.

Involuntary Conversion

An event where property or assets are destroyed, stolen, confiscated, or condemned, forcing the owner to replace them or receive compensation, often with tax implications.

Adjusted Basis

is the original cost of a property adjusted for factors such as depreciation or improvements, used to calculate capital gains or losses.

Non-recognition of Gain

A tax principle that allows taxpayers to defer recognition of capital gains taxes if the gains are reinvested in similar property or under certain qualifying exchanges.

Q5: A function and its graph are given.Use

Q10: Find the average value of the function

Q17: The mere possession of land without right

Q18: A brick becomes dislodged from the Empire

Q31: For a party to take by adverse

Q36: Gary dies without a will. His survivors

Q83: Find the open intervals on which the

Q104: The profit P (in thousands of dollars)for

Q215: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1301/.jpg" alt="Find ,if

Q326: Determine the open intervals on which the