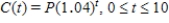

With an annual rate of inflation of 4% over the next 10 years,the approximate cost of goods or services during any year in the decade is given by  where t is the time (in years) and P is the present cost.The price of an oil change for a car is presently $24.95.Estimate the price 10 years from now.Round your answer to the nearest cent.

where t is the time (in years) and P is the present cost.The price of an oil change for a car is presently $24.95.Estimate the price 10 years from now.Round your answer to the nearest cent.

Definitions:

Payroll Taxes Expense

The cost incurred by employers for taxes associated with employee salaries, such as Social Security and Medicare taxes.

FICA Social Security Taxes

Taxes collected under the Federal Insurance Contributions Act that fund Social Security and Medicare programs.

FICA Medicare

The portion of the U.S. Federal Insurance Contributions Act tax that funds Medicare, providing health insurance to individuals over 65 and some younger with disabilities.

Federal Unemployment Taxes

Taxes imposed by the federal government on employers to fund state unemployment agencies and provide unemployment compensation to workers who have lost their jobs.

Q21: An insurance company needs to determine the

Q30: The rate of change in the number

Q47: Use the given information to write an

Q69: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1301/.jpg" alt="If ,find

Q78: Write the following expression as a logarithm

Q79: After t years,the remaining mass y(in grams)of

Q98: Analytically determine the location of any vertical

Q102: Find three positive numbers x,y,and z whose

Q303: Determine the dimensions of a rectangular solid

Q371: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1301/.jpg" alt="Find