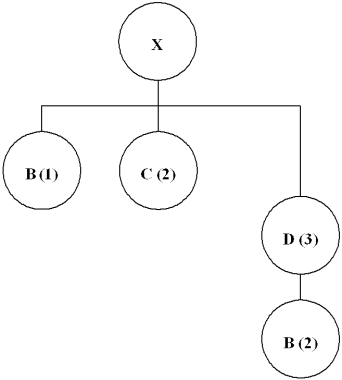

The BOM for Product X is shown below, followed by a table of inventory data. The master production schedule quantity calls for the completion of 300 Xs in Week 7. The lead-time for production of X is 2 weeks and there are currently no units of X available.

a. When and what quantity will be the planned order release for Item C?

b. Determine the week and the quantity of the planned order release for Item D.

Definitions:

Mispriced Stocks

Stocks whose market prices do not accurately reflect their intrinsic value due to various factors such as information asymmetry.

Strong-Form Efficient

A market hypothesis that assumes all information, both public and private, is completely factored into stock prices at all times, making it impossible to consistently achieve higher returns.

Insider Information

Confidential information about a company that has not been made public, which can give an advantage in financial trading.

Net Present Value

A method used in capital budgeting to evaluate the profitability of an investment or project by calculating the total value of its future cash flows discounted back to their present value.

Q1: Refer to Figure 9.1.What is the profit-maximizing

Q11: In the define phase of the Six

Q12: A 7-month simple moving average would

Q13: Refer to Figure 8.6,which shows just three

Q22: In applying Six Sigma to services, the

Q26: Define root cause and describe root cause

Q49: The center-of-gravity model minimizes the weighted distance

Q57: Which of the following is least related

Q58: For General Motors' supply chain, the _

Q83: Good solutions to aggregate planning situations can