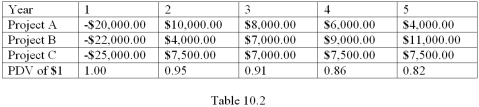

The Table 10.2 below shows net cash flows for 3 mutually exclusive projects from which a company can choose.Each project requires an investment in the first year,then produces a positive net cash flow for each of the following four years.Assuming an interest rate of 5%,which project would the company choose? Does the best project have the highest total net cash flow? The shortest payback period?

Definitions:

Bad Debt Expense

The estimated amount of credit sales that a company does not expect to collect due to customer's inability to fulfill payment obligations.

Uncollectible

Financial term referring to accounts receivable that are considered unlikely to be collected due to debtor default.

GAAP

Generally Accepted Accounting Principles; a collection of commonly-followed accounting rules and standards for financial reporting.

Allowance Method

An accounting technique used to account for bad debts by estimating uncollectible accounts at the end of each period.

Q3: A strategy is dominant if<br>A) It is

Q16: A production possibility graph slopes down because

Q23: A movie monopolist sells to students and

Q25: Refer to Figure f.A benefit function is

Q48: Assume Brandon's benefit function for water is

Q52: A firm's markup<br>A) Is the amount by

Q63: Suppose you are thinking about spending an

Q63: Suppose a price ceiling is set by

Q66: In Exhibit 4.5, assume that the government

Q75: Which of the following is a statement