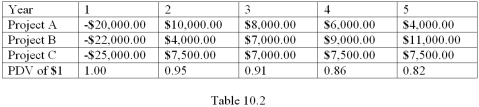

The Table 10.2 below shows net cash flows for 3 mutually exclusive projects from which a company can choose.Each project requires an investment in the first year,then produces a positive net cash flow for each of the following four years.Assuming an interest rate of 5%,which project would the company choose? Does the best project have the highest total net cash flow? The shortest payback period?

Definitions:

Inferior Vena Cava

The large vein that carries deoxygenated blood from the lower half of the body into the heart.

Right Atrium

The right upper chamber of the heart that receives deoxygenated blood from the body through the venae cavae and pumps it into the right ventricle.

Systole

The phase of the heart cycle during which the heart muscles contract and pump blood into the arteries.

Contraction Phase

The period during a muscle contraction when muscle fibers shorten and tension increases, typically measured in an isotonic contraction.

Q3: With free entry<br>A) The long run market

Q6: According to the law of demand:<br>A) as

Q9: Aggregate surplus<br>A) Is maximized under perfect competition<br>B)

Q12: In a capitalist economy,the opportunities and procedures

Q23: The efficient efficiency condition holds<br>A) If every

Q35: Refer to Figure b.Given the game described

Q49: The theory of comparative advantage:<br>A) helps to

Q52: A market failure<br>A) Is a source of

Q58: The production possibilities curve for the nation

Q70: Macroeconomics is concerned with:<br>A) the study of