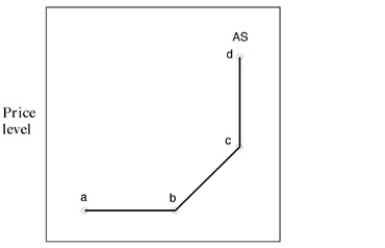

Narrbegin Exhibit 14.1 Aggregate supply curve

-In Exhibit 14.1, higher price levels allow producers to earn higher profits, stimulating production and employment in:

Definitions:

Social Security Tax

Taxes levied on both employers and employees to fund the Social Security program, which provides retirement, disability, and survivor benefits.

Taxable Income

The amount of an individual's or corporation's income used to determine how much tax is owed to the government.

Marginal Tax Rate

The percentage of tax applied to your income for every tax bracket in which you qualify.

Average Tax Rate

The fraction of an individual's total income that is paid in taxes, calculated by dividing the total taxes paid by total income.

Q15: The monetarist transmission mechanism, through which monetary

Q28: Net national product is the total net

Q30: According to Keynesian economics, fiscal policy should

Q39: Gross domestic product includes:<br>A) intermediate as well

Q39: As a proportion of GDP, if estimated

Q50: Which one of the following statements is

Q51: Macroeconomic policies involve:<br>A) fiscal and monetary policy.<br>B)

Q65: Regulation can encourage firms to:<br>A) introduce processes

Q66: Which of the following would be included

Q92: The aggregate supply curve is:<br>A) always vertical.<br>B)