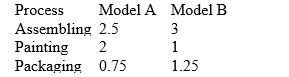

A company makes two models of doghouses.The times (in hours) required for assembling, painting, and packaging are shown in the table.  The total times available for assembling, Painting, and packaging are 4000 hours, 2500 hours, and 1500 hours, respectively.The profits per unit are $60 for model A and $75 for model B.what is the optimal production level for each model? What is the optimal profit?

The total times available for assembling, Painting, and packaging are 4000 hours, 2500 hours, and 1500 hours, respectively.The profits per unit are $60 for model A and $75 for model B.what is the optimal production level for each model? What is the optimal profit?

Definitions:

Exchange Rate

The rate at which one currency can be exchanged for another, usually used in the context of foreign exchange markets.

Firm's Beta

A measure of a company's stock volatility compared to the market as a whole, indicating its relative risk.

Profits

The financial gain realized when the amount of revenue gained from a business activity exceeds the expenses, costs, and taxes needed to sustain the activity.

Interest Rate Volatility

The degree of variation of interest rates over time, impacting the valuation of financial instruments and the ability to forecast future rates.

Q26: Match the equation below with its graph.

Q30: Decide whether the function is even, odd,

Q30: A company is preparing a common

Q38: Find the inverse of the matrix below,

Q78: Expand the given logarithmic expression.Assume all variable

Q89: General-purpose financial statements include the (1)_, (2)_,

Q105: Find all real zeros of the polynomial

Q131: A company reported net income of $78,000

Q162: An investment that is readily convertible to

Q189: The current ratio and acid-test ratio are