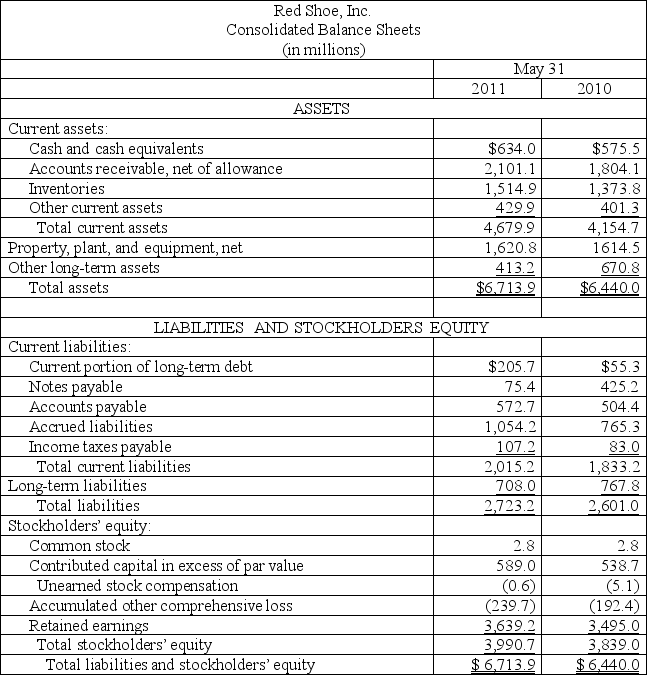

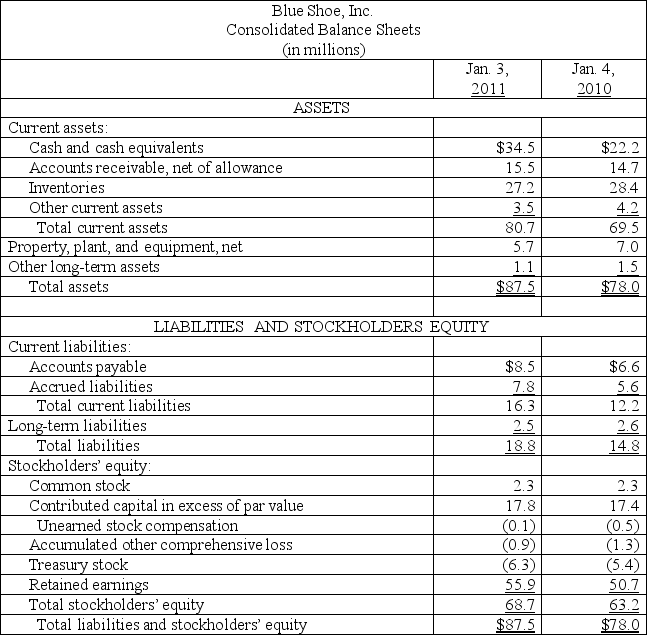

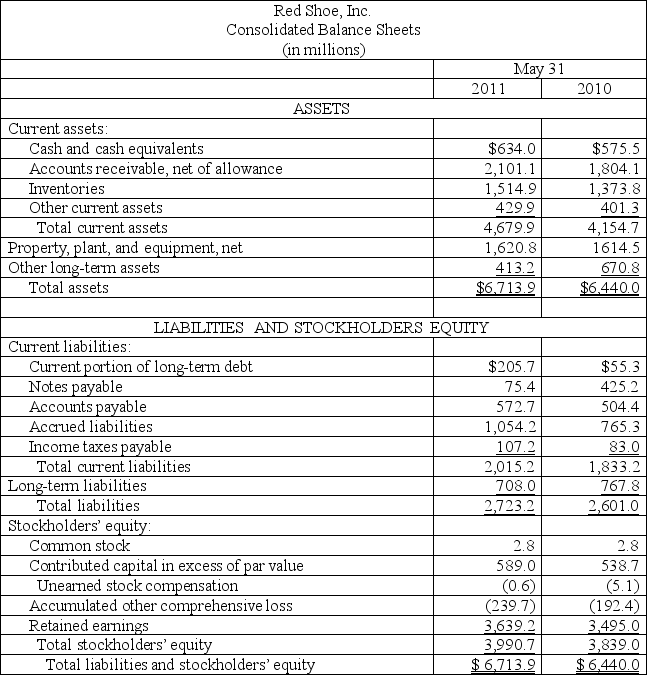

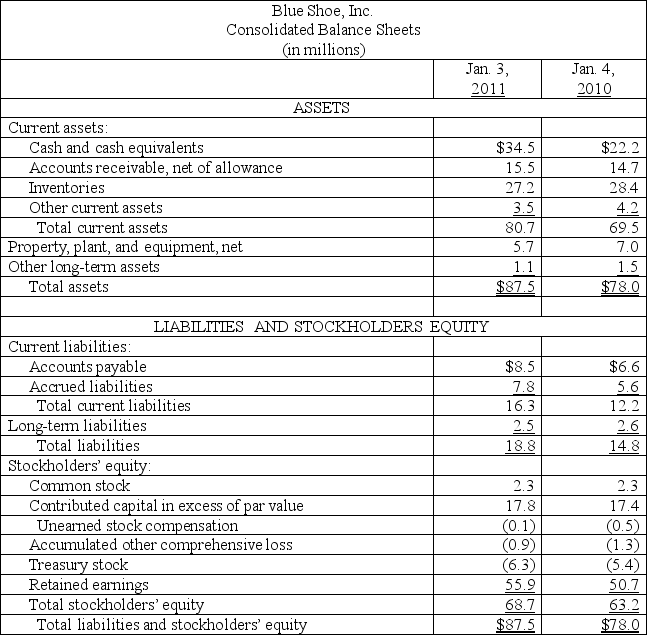

The following are summaries from the Income Statements and Balance Sheets of Red Shoe,Inc.and Blue Shoe,Inc.

Red Shoe, Inc. Consolidated Statement of Income May 31,2011 (in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Income before effect of accounting change Cumulative effect of accounting change, net of tax Net income $10,697.06,313.64,383.43,137.61,245.842.979.91,123.0382.9740.1266.1$474.0

Blue Shoe, IncConsolidated Statement of IncomeJanuary 3, 2011(in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Net income $133.587.346.237.38.9(0.1)0.39.13.9$5.2

(1)For both companies compute the following ratios for 2011:

(a)Current ratio

(b)Acid-test ratio

(c)Accounts receivable turnover

(d)Inventory turnover

(e)Days' sales in inventory

(f)Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2)For both companies compute the following ratios for 2011:

(a)Profit margin ratio

(b)Return on total assets

(c)Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Definitions:

Deliberately Alters

Intentionally change or modify something with a specific purpose or outcome in mind.

Computer's Operations

The fundamental tasks and processes that a computer performs to execute programs and manage data.

Malware

Malicious software designed to damage, disrupt, or gain unauthorized access to computer systems.

Blocked Website Lists

Lists used by software or network administrators to prevent access to specific websites deemed inappropriate or harmful.