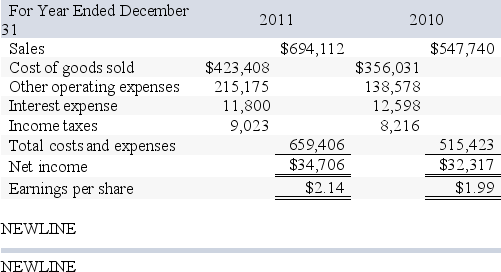

Simple Simon's Balance Sheet and Income Statement Accounts Follow What Is Simple Simon's Times Interest Earned Ratio for 2010

Simple Simon's balance sheet and income statement accounts follow:

What is Simple Simon's times interest earned ratio for 2010?

Definitions:

Absolute Advantage

The ability of an entity to produce a good or offer a service more efficiently than its competitors when using the same amount of resources.

Absolute Advantage

The capability of an individual, company, or country to produce a good or service at a lower cost per unit than competitors.

Comparative Advantage

The ability of an entity to produce a good or service at a lower opportunity cost than another entity, leading to more efficient trade and production.

Comparative Advantage

The ability of an entity to produce a good or service at a lower opportunity cost than others.

Q8: Condense the expression <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2036/.jpg" alt="Condense the

Q22: A company has a current ratio of

Q39: Liquidity and efficiency are considered the building

Q45: One acetic acid solution is 60% water

Q48: Determine whether the sequence is geometric.If so,

Q72: Use algebraic procedures to find the exact

Q73: A company has total assets of $5,600,482,common

Q89: The demand function for a home theater

Q103: Working capital is computed as current liabilities

Q187: A company reported $990,000 in net income